Worried About Future Health Care Costs?

If so, you’re not alone. Studies show this subject is at the top of the list for most people preparing for retirement. And if you’re out of the workforce prior to Medicare eligibility, look out! Private health insurance is prohibitively expensive as premiums rose 60% in the last five years.

So could retiring abroad be a possible solution? What’s it like going to a doctor or, yikes, the hospital in a foreign country? Is medical insurance available? What are the costs? Would you feel safe? Let’s dive right in and answer all of those very legitimate concerns.

How Different Is the Health Care?

When we announced we planned to move to Ecuador, one of our relatives asked if we were going to live in a grass hut and ride a donkey. He probably also wondered if we would visit a witch doctor or voodoo priest when we got sick. He, and you, might be surprised to learn that fabulous health care is available outside the U.S. at a fraction of the cost.

Modern facilities and equipment. Internationally trained physicians, many of whom speak English.

But that doesn’t mean everything is the same. Those cultural differences we talked about in Part 2 of this series are front and center in this aspect of daily life as well. Shortly after we arrived in Cuenca, Cynthia scheduled an appointment with a dermatologist. At that early stage we were doing well just to get home, so she was thrilled to find the building and happily burst through the door into the waiting room. Except—there was no waiting room. Or staff. She found herself standing right in the doctor’s office as he was interviewing a patient. Oops! She sheepishly took a seat in the hallway and waited her turn.

Is Health Insurance Available?

As Medicare coverage does not extend beyond U.S. borders, what other options are available? International policies are the easiest and most expensive choice. In addition, after gaining permanent residence status, expats in many countries are eligible for national health care insurance. Many expats choose instead to simply pay out of pocket as needs arise since services, procedures, and medications abroad are so inexpensive,

We found that a hybrid approach works best for us. Medicare provides coverage for our frequent trips back to the States. As members of Ecuador’s national health care system we have 100% coverage with $0 deductible and no restrictions for age or pre-existing conditions. Total monthly premiums- $81. But because members cannot choose their doctor we also pay out of pocket for specialists like our dentist and Cynthia’s ophthalmologist.

What Are the Costs?

You probably did a double take when you saw what we pay for public health insurance. Especially considering the level of coverage.

In the private sector, Edd recently got a cosmetic filling, veneer, and crown for $250. Several years ago Cynthia had cataract surgery and lens replacement in one of her eyes for around $1500. Drugs are super low in cost and most are available over the counter. We could go on and on with examples, but you get the picture.

Is the Care Provided Safe and Effective?

Two years ago, Cynthia had a major health scare and spent an entire week in a private room at the hospital. The doctors followed world-class protocol for her treatment. Edd had surgery in the same facility for a delicate hand condition with a high degree of reoccurrence. He mentioned this to the specialist who replied, “I’ve never had that happen and you won’t be the first.” Nuff said. In both cases we were discharged with follow-up appointments made, prescribed meds in hand, and a total bill of $0.

The Bottom Line

Health care abroad is highly affordable and can be excellent. Not in every country, of course, and as in the States, the farther you live from major metropolitan areas the more quality declines. We strongly advise “boots on the ground” due diligence for this important aspect of expat life. Online forums are helpful for feedback and referrals, but before making a final decision you need to show up, look around, and ask plenty of questions to make sure you’re comfortable moving forward.

Our personal experience has been extremely positive. We’ve found the level of care and caring, low cost, and lack of bureaucracy a refreshing change from everything the U.S. health care system has become.

Here’s to your health!

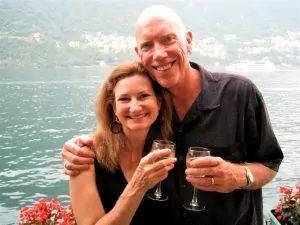

About the Authors: Edd and Cynthia Staton

Edd and Cynthia Staton are the creators of Retirement Reimagined!, a revolutionary Master Course for Baby Boomers facing an uncertain future. Recognized as experts on expat living, they have appeared on network television and written hundreds of articles for international magazines and other media outlets. As featured speakers at large global events, they have shared their expertise on moving and retiring abroad with thousands of attendees.

Each volume of Edd and Cynthia’s trilogy of books, Mission: Rescue Your Retirement is an Amazon Best Seller. The collection hit #1 in 10 categories as diverse as comedy, personal finance, retirement planning, self-help, and travel. Visit them at eddandcynthia.com.